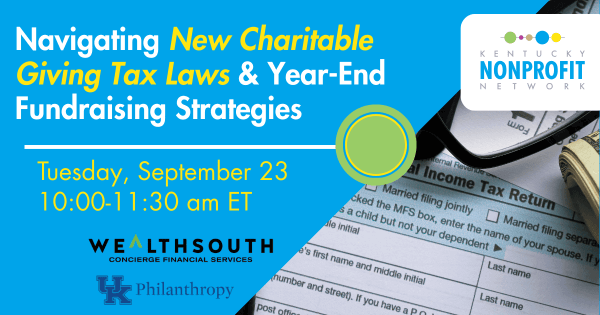

Navigating New Charitable Giving Tax Laws & Year-End Fundraising Strategies (Partner, Virtual)

Virtual Training

Event Details

Navigating New Charitable Giving Tax Laws & Year-End Fundraising Strategies

As you finalize your year-end fundraising strategy, new tax law changes regarding charitable giving tax incentives will be important to consider and communicate. This webinar will break down the new changes in the One Big Beautiful Bill and what they mean for individuals, corporations, and your nonprofit. Hear directly from tax, investment, and nonprofit leaders on what you need to know to best prepare for how these changes could impact donor behavior and strategies for effectively communicating and soliciting your donors.

Speakers and panelists include: Clint Long (Vice President, Institutional Services, Wealthsouth), Kateena Haynes (CEO, Boys & Girls Clubs of Appalachia), Tawanda Owsley (Vice President of Development, Hosparus Health), and Sarah Kerrick (Senior Tax Manager, DMLO CPAs).

Session hosted by NAM partner, Kentucky Nonprofit Network

Fee:

- $35 for KNN & NAM members

- $55 for nonmembers

- NAM Members - choose the KNN Potential Member registration option and apply the promo code NAM2025 to receive member rate

Location: Live webinar - from the comfort of your desk!

- Public Policy and Advocacy

- Fundraising/Development